The New York Times editor Bill Keller justified their decision to alert Al Qaeda and other terror networks that we are tracking their financial transactions by saying that the story was "in the public interest".

There are a few other things which I would like to remind the Times are also in the public interest.

We are currently fighting an enemy who wants to kill us.

They don't approach this goal with the same style of warfare that was used in World War II and most of the other wars which preceded this one. Instead of relying on airplanes, tanks, and infantry brigades, they hide among the civilian population, using the same women and children who they intend to murder as a shield and as camouflage. Their goal is that we never recognize who they are or what their intentions are until they hijack an airliner, bomb a building, or use some other method to murder hundreds of innocent civilians. Our military might is nearly useless against this kind of threat. There is no advancing column of troops to attack, and our high-tech Air Force is useless against an enemy that we can't find.

To fight this enemy, we first need to identify and locate them.

Thus, intelligence is the most critical element in the War on Terror. And there are only a few ways to obtain that intelligence. When we capture a terrorist, we can squeeze him for information which will be useful in thwarting the plans of his companions. We can trace and intercept terrorist communications. Or we can track the flow of their money, a necessary ingredient to turn their murderous intentions into action.

Intelligence -- finding out where the enemy is and what they plan to do -- is a necessary part of any war. George Washington said that the “necessity of procuring good intelligence is apparent and need not be further urged…. upon Secrecy, Success depends in Most Enterprises ... and for want of it, they are generally defeated.” Conventional wars often turned on an intelligence breakthrough rather than a military victory. In World War II, we broke the Japanese code and used the resulting information to give us the edge in ending the war. Today, intelligence is even more important because of the asymmetrical nature of the conflict -- terrorists rely on being undetected because they can not fight a war on a level playing field.

The goal of intelligence in the War on Terror is to give us an advantage by gathering information about our enemy which we can exploit to prevent them from committing their acts of mass murder. This information must be used in such as way that it does not reveal our methods of gathering the information, or alert the enemy to what we know. Without secrecy, intelligence gathering is useless. Just a few weeks ago, an Iraqi informant revealed the location of twenty safe houses used by Zarqawi, the murderous leader of Al Qaeda in Iraq. If the identity of the informant had been announced before he could provide this crucial information, he would not have lived long enough to help us achieve a major victory in the War on Terror. Once we had the list of safe houses, if we had started randomly raiding them one at a time, we would have alerted Zarqawi that his network of safe houses had been compromised, and he would not have been meeting in one of them on that fine Thursday morning when two F-16s cut his meeting short. Instead, we waited until the right moment to raid all twenty safe houses and take out Zarqawi in one highly coordinated swoop.

The New York Times is highly committed to exposing government activities which it deems to be "in the public interest". Bill Keller, the editor of the Times complains about the lack of checks and balances, but what are the checks and balances on Bill Keller? Why should this one man who is not accountable to the voters be allowed to make decisions which will cost American lives?

If you want to talk about legality and the public interest, someone in the US Government is illegally leaking classified information to the media which is compromising the security of our nation and endangering lives by undermining our ability to collect the intelligence needed to prevent another terror attack. It is in all of our interest to know who it is. The New York Times knows. But they would rather tip off Al Qaeda to the fact that we are tracking their money transfers.

The New York Times is willing to give a tactical advantage to the enemy during wartime because they have unilaterally declared it to be "in the public interest" but they are not about to expose a public official who has violated both the law and his position of responsibility and betrayed his country by leaking classified information to the media for political gain. It seems to me that their commitment to "the public interest" is not as deep as they would like us to believe.

Wednesday, June 28, 2006

Thursday, June 22, 2006

70% is not good enough

Science is always trying to accomplish the same results obtained by simply obeying God, but they can never equal the blessings of obedience.

A recently released study found that using a condom during sex could reduce the risk of cervical cancer by up to 70%. Of course, for it to work that way, a condom must be used every single time without fail.

More than 99% of invasive cervical cancers are caused by HPV, human papillomavirus, a sexually transmitted disease. Studies have shown that roughly 90% of all people who have had multiple sexual partners during their life carry HPV. HPV can cause genital warts and lesions, but it can also cause abnormal cells on the cervix which if untreated can lead to cervical cancer. Pap smears can detect these cells and alert a woman to the need for further diagnostic tests and immediate treatment to prevent cancer from developing or spreading.

Now I love my wife very much, and I don’t want to be the cause of her death from cervical cancer. Reducing the risk by 70% sounds good, but are we really going to use condoms for our entire married life? Not likely. I am not going to play the odds, hoping that she won’t die as a result of something I did years before I met her, when I was young and stupid. I want a better solution. And there is a better solution which is a lot more than 70% effective. If I never get HPV and she never gets HPV, then we can’t give it to each other. It is so simple that the experts have not even figured it out yet.

The experts say that it can’t work because it requires that we exercise some self-control rather than act as hormone-driven animals that just can’t help what they do. It requires a decision of the will to trade immediate gratification for a blessing which lasts a lifetime. It calls for a young man to have the maturity to value the life of his future bride, even if he has not met her yet, over a short-lived thrill. The experts say it can’t happen. I am testimony to the fact that it can.

Which revolutionary scientific research study found this method to prevent cervical cancer? Which medical journal reported the findings? And when will the FDA approve it? Actually it can be found in the Bible, written thousands of years before man invented condoms, understood viruses, or studied oncology. It is God’s plan for marriage. It is a man and a woman saving God’s sacred gift of sex for each other only, and only within the covenant of marriage. It is further proof that God knows what he is doing and acts in the best interest of his creation. And the blessings go far beyond preventing HPV and cervical cancer. Being “the one and only” is an indescribable gift that you and your spouse can give to each other, laying a foundation of trust and faithfulness to build a lasting marriage on. Let me tell you, God’s way is not easy, but it is the best.

A recently released study found that using a condom during sex could reduce the risk of cervical cancer by up to 70%. Of course, for it to work that way, a condom must be used every single time without fail.

More than 99% of invasive cervical cancers are caused by HPV, human papillomavirus, a sexually transmitted disease. Studies have shown that roughly 90% of all people who have had multiple sexual partners during their life carry HPV. HPV can cause genital warts and lesions, but it can also cause abnormal cells on the cervix which if untreated can lead to cervical cancer. Pap smears can detect these cells and alert a woman to the need for further diagnostic tests and immediate treatment to prevent cancer from developing or spreading.

Now I love my wife very much, and I don’t want to be the cause of her death from cervical cancer. Reducing the risk by 70% sounds good, but are we really going to use condoms for our entire married life? Not likely. I am not going to play the odds, hoping that she won’t die as a result of something I did years before I met her, when I was young and stupid. I want a better solution. And there is a better solution which is a lot more than 70% effective. If I never get HPV and she never gets HPV, then we can’t give it to each other. It is so simple that the experts have not even figured it out yet.

The experts say that it can’t work because it requires that we exercise some self-control rather than act as hormone-driven animals that just can’t help what they do. It requires a decision of the will to trade immediate gratification for a blessing which lasts a lifetime. It calls for a young man to have the maturity to value the life of his future bride, even if he has not met her yet, over a short-lived thrill. The experts say it can’t happen. I am testimony to the fact that it can.

Which revolutionary scientific research study found this method to prevent cervical cancer? Which medical journal reported the findings? And when will the FDA approve it? Actually it can be found in the Bible, written thousands of years before man invented condoms, understood viruses, or studied oncology. It is God’s plan for marriage. It is a man and a woman saving God’s sacred gift of sex for each other only, and only within the covenant of marriage. It is further proof that God knows what he is doing and acts in the best interest of his creation. And the blessings go far beyond preventing HPV and cervical cancer. Being “the one and only” is an indescribable gift that you and your spouse can give to each other, laying a foundation of trust and faithfulness to build a lasting marriage on. Let me tell you, God’s way is not easy, but it is the best.

Thursday, June 15, 2006

My prediction for the 2006 election

The Democrats are convinced that they are going to win big in November.

I predict otherwise.

Most of the Democrats' hopefulness is based on George Bush's approval poll numbers. Democrats forget that Bush is not up for re-election. They also forget that Bush's poll numbers don't mean a thing if their numbers are not any better. And they have consistently failed to turn Bush's sinking poll numbers into rising numbers in their column.

For many months, the unveiling of the Democrats agenda for the future of America has been as imminent as the indictment of Karl Rove. They assure us that they will have figured out what they believe any day now, one of these months. What is clear is that they still have not learned the lessons of the past.

They keep pushing the failed policies of the Great Society, with a firm belief that prosperity comes from pouring more money into more government programs. But government can not make a country innovative or industrious. Higher taxes, more bureaucracy, and increased entitlement spending will not spur our economy on to create more and better jobs. More regulation and a higher tax burden on businesses will not promote entrepreneurialism, the driving force behind our nation's greatness. America is not the strongest nation on earth because of our government. We achieved our current stature because of the private sector and the hard work of our people, and we did it in spite of government. The best thing that our government can do is get out of the way and let Americans do what we do best. But Democrats don't understand that. Their policies are based on the assumption that government is the only solution to any problem, and that you can tax a nation to prosperity.

Democrats also believe that if you are nice to terrorists, they will go away. This was the policy during the eight years of Clinton. When terrorists bombed the World Trade Center, attacked the USS Cole, or bombed our military barracks and embassies, President Clinton got on television and bit his lower lip. Then he vowed to find the people responsible for this awful crime and bring them to justice. But in the end, Clinton spent more money and resources going after Bill Gates than he did going after terrorists. His response was more like the investigation of a crime scene than engagement in a war. The only concrete action was the bombing of an aspirin factory and blowing up a few tents. Our appeasement paid off on 9/11 when they crashed airliners into the World Trade Center and Pentagon. But Democrats still have not learned. They want to go back to Clintonesque policies, leave the terrorists alone, bury our heads in the sand, and hope that Bin Laden and his crew will be touched by our kindness and stop trying to kill us.

So the Democrats will lose in November, because they offer nothing. They count on the rest of the country hating George Bush as much as they do. The only thing they offer the voting public is that "I'm not George Bush." But when people begin to compare the Democrats to George Bush, they will find solid and consistent leadership from Bush and nothing but name calling and triangulation from the Democrats. Most of the voters will see through the Democrats ploy, and in the end, the big win that the Left has been salivating for will not happen.

If you think that you liberal co-worker was devastated by the death of Zarqawi, just wait for November 8.

I predict otherwise.

Most of the Democrats' hopefulness is based on George Bush's approval poll numbers. Democrats forget that Bush is not up for re-election. They also forget that Bush's poll numbers don't mean a thing if their numbers are not any better. And they have consistently failed to turn Bush's sinking poll numbers into rising numbers in their column.

For many months, the unveiling of the Democrats agenda for the future of America has been as imminent as the indictment of Karl Rove. They assure us that they will have figured out what they believe any day now, one of these months. What is clear is that they still have not learned the lessons of the past.

They keep pushing the failed policies of the Great Society, with a firm belief that prosperity comes from pouring more money into more government programs. But government can not make a country innovative or industrious. Higher taxes, more bureaucracy, and increased entitlement spending will not spur our economy on to create more and better jobs. More regulation and a higher tax burden on businesses will not promote entrepreneurialism, the driving force behind our nation's greatness. America is not the strongest nation on earth because of our government. We achieved our current stature because of the private sector and the hard work of our people, and we did it in spite of government. The best thing that our government can do is get out of the way and let Americans do what we do best. But Democrats don't understand that. Their policies are based on the assumption that government is the only solution to any problem, and that you can tax a nation to prosperity.

Democrats also believe that if you are nice to terrorists, they will go away. This was the policy during the eight years of Clinton. When terrorists bombed the World Trade Center, attacked the USS Cole, or bombed our military barracks and embassies, President Clinton got on television and bit his lower lip. Then he vowed to find the people responsible for this awful crime and bring them to justice. But in the end, Clinton spent more money and resources going after Bill Gates than he did going after terrorists. His response was more like the investigation of a crime scene than engagement in a war. The only concrete action was the bombing of an aspirin factory and blowing up a few tents. Our appeasement paid off on 9/11 when they crashed airliners into the World Trade Center and Pentagon. But Democrats still have not learned. They want to go back to Clintonesque policies, leave the terrorists alone, bury our heads in the sand, and hope that Bin Laden and his crew will be touched by our kindness and stop trying to kill us.

So the Democrats will lose in November, because they offer nothing. They count on the rest of the country hating George Bush as much as they do. The only thing they offer the voting public is that "I'm not George Bush." But when people begin to compare the Democrats to George Bush, they will find solid and consistent leadership from Bush and nothing but name calling and triangulation from the Democrats. Most of the voters will see through the Democrats ploy, and in the end, the big win that the Left has been salivating for will not happen.

If you think that you liberal co-worker was devastated by the death of Zarqawi, just wait for November 8.

Thursday, June 08, 2006

Sincere Condolences

I offer my sincere condolences to all liberal Democrats and their propoganda branch, the mainstream media, who today have lost a brother in their struggle against President George Bush.

Monday, June 05, 2006

What tax rate are we paying?

One of my handful of faithful readers had a question about my "Productivity Curve" concept. He wanted to know what our current tax rate is. He said that he pays a lot less than 33% in taxes.

He probably pays more than he thinks.

We all pay layers and layers of different taxes to the federal government, state government, and local government. Some are direct and others are indirect. Some are visible and some are hidden. My Federal income tax bill is also quite a bit less than 33% of my income. It is somewhere around 10%. But adding up all of the taxes that I pay is a daunting task. The payroll taxes for Medicare and Social Security are about 15%. My property tax bill each year is also quite large. It is not determined as a percentage of my income, but if it was, it would be another 6% or so. That gets us up to 31%, and we have not started to account for sales tax, gasoline taxes, and all of the other tax expenses passed on to me in the cost of the things I buy.

As an example, when I buy one gallon of gasoline at the current price of $2.75, the government takes 53 cents in direct taxation. 18.3 cents goes to the federal excise tax, and the rest goes to the state. But that is not all. The government imposes 43 different taxes on the import, production, and distribution of gasoline. These costs are passed on to me in higher prices. In all, I pay 73 cents in taxes on every gallon of gasoline I buy. But to pay $2.75 in after-tax dollars, I have to earn significantly more than $2.75. At my total marginal tax rate of 40% (including income tax and payroll tax) I have to earn $4.58 to take home $2.75. So to buy $2.02 worth of gas, I must earn $4.58. The government takes the difference: $2.56. My effective tax rate on the money I earned is 55%.

The tax rate varies widely depending on who earns the money and what they do with it. A lower income person pays a lower income tax rate, but a higher payroll tax rate. They also tend to pay more in sales taxes. A higher income person pays a higher income tax rate and lower payroll tax rate. The tax rate is higher if the money is spent on certain high-tax items. It is lower if the money is invested in a tax-sheltered account.

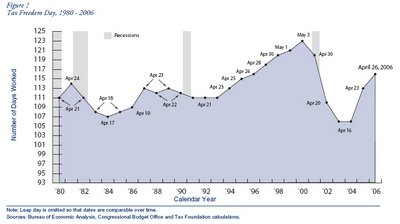

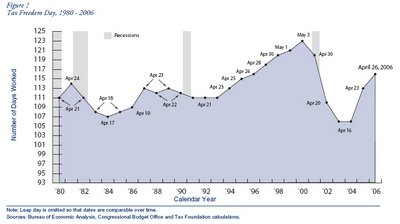

There is one way to determine the national tax rate, including all direct and indirect taxes, and even future tax liabilities created by deficit spending. Total government spending as a percentage of the size of the economy is the ultimate measure of the tax rate. Whatever the government spends, it takes from the economy in some way: either by direct taxation, by borrowing the money obligating them to take it at a later time, or by printing money and diluting the value of the existing money. Each year the Tax Foundation computes the tax rate using this method, and determines the "Tax Freedom Day". Last year, Tax Freedom Day was April 26, meaning that everything we produce and earn from January 1 to April 25 goes to fund the government. This is a 31.8% tax rate. The highest tax rate since World War II occurred during President Clinton's term, when the tax rate hit 33.6%.

As a whole, our government consumes roughly one third of what the private sector creates. There are other countries with higher tax rates. However, the truth remains that no nation has ever taxed itsself to prosperity. America achieves prosperity in spite of government, not because of it. The best thing that the government can do to increase prosperity is get out of the way.

He probably pays more than he thinks.

We all pay layers and layers of different taxes to the federal government, state government, and local government. Some are direct and others are indirect. Some are visible and some are hidden. My Federal income tax bill is also quite a bit less than 33% of my income. It is somewhere around 10%. But adding up all of the taxes that I pay is a daunting task. The payroll taxes for Medicare and Social Security are about 15%. My property tax bill each year is also quite large. It is not determined as a percentage of my income, but if it was, it would be another 6% or so. That gets us up to 31%, and we have not started to account for sales tax, gasoline taxes, and all of the other tax expenses passed on to me in the cost of the things I buy.

As an example, when I buy one gallon of gasoline at the current price of $2.75, the government takes 53 cents in direct taxation. 18.3 cents goes to the federal excise tax, and the rest goes to the state. But that is not all. The government imposes 43 different taxes on the import, production, and distribution of gasoline. These costs are passed on to me in higher prices. In all, I pay 73 cents in taxes on every gallon of gasoline I buy. But to pay $2.75 in after-tax dollars, I have to earn significantly more than $2.75. At my total marginal tax rate of 40% (including income tax and payroll tax) I have to earn $4.58 to take home $2.75. So to buy $2.02 worth of gas, I must earn $4.58. The government takes the difference: $2.56. My effective tax rate on the money I earned is 55%.

The tax rate varies widely depending on who earns the money and what they do with it. A lower income person pays a lower income tax rate, but a higher payroll tax rate. They also tend to pay more in sales taxes. A higher income person pays a higher income tax rate and lower payroll tax rate. The tax rate is higher if the money is spent on certain high-tax items. It is lower if the money is invested in a tax-sheltered account.

There is one way to determine the national tax rate, including all direct and indirect taxes, and even future tax liabilities created by deficit spending. Total government spending as a percentage of the size of the economy is the ultimate measure of the tax rate. Whatever the government spends, it takes from the economy in some way: either by direct taxation, by borrowing the money obligating them to take it at a later time, or by printing money and diluting the value of the existing money. Each year the Tax Foundation computes the tax rate using this method, and determines the "Tax Freedom Day". Last year, Tax Freedom Day was April 26, meaning that everything we produce and earn from January 1 to April 25 goes to fund the government. This is a 31.8% tax rate. The highest tax rate since World War II occurred during President Clinton's term, when the tax rate hit 33.6%.

As a whole, our government consumes roughly one third of what the private sector creates. There are other countries with higher tax rates. However, the truth remains that no nation has ever taxed itsself to prosperity. America achieves prosperity in spite of government, not because of it. The best thing that the government can do to increase prosperity is get out of the way.

Subscribe to:

Posts (Atom)