He probably pays more than he thinks.

We all pay layers and layers of different taxes to the federal government, state government, and local government. Some are direct and others are indirect. Some are visible and some are hidden. My Federal income tax bill is also quite a bit less than 33% of my income. It is somewhere around 10%. But adding up all of the taxes that I pay is a daunting task. The payroll taxes for Medicare and Social Security are about 15%. My property tax bill each year is also quite large. It is not determined as a percentage of my income, but if it was, it would be another 6% or so. That gets us up to 31%, and we have not started to account for sales tax, gasoline taxes, and all of the other tax expenses passed on to me in the cost of the things I buy.

As an example, when I buy one gallon of gasoline at the current price of $2.75, the government takes 53 cents in direct taxation. 18.3 cents goes to the federal excise tax, and the rest goes to the state. But that is not all. The government imposes 43 different taxes on the import, production, and distribution of gasoline. These costs are passed on to me in higher prices. In all, I pay 73 cents in taxes on every gallon of gasoline I buy. But to pay $2.75 in after-tax dollars, I have to earn significantly more than $2.75. At my total marginal tax rate of 40% (including income tax and payroll tax) I have to earn $4.58 to take home $2.75. So to buy $2.02 worth of gas, I must earn $4.58. The government takes the difference: $2.56. My effective tax rate on the money I earned is 55%.

The tax rate varies widely depending on who earns the money and what they do with it. A lower income person pays a lower income tax rate, but a higher payroll tax rate. They also tend to pay more in sales taxes. A higher income person pays a higher income tax rate and lower payroll tax rate. The tax rate is higher if the money is spent on certain high-tax items. It is lower if the money is invested in a tax-sheltered account.

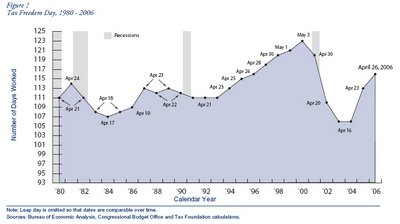

There is one way to determine the national tax rate, including all direct and indirect taxes, and even future tax liabilities created by deficit spending. Total government spending as a percentage of the size of the economy is the ultimate measure of the tax rate. Whatever the government spends, it takes from the economy in some way: either by direct taxation, by borrowing the money obligating them to take it at a later time, or by printing money and diluting the value of the existing money. Each year the Tax Foundation computes the tax rate using this method, and determines the "Tax Freedom Day". Last year, Tax Freedom Day was April 26, meaning that everything we produce and earn from January 1 to April 25 goes to fund the government. This is a 31.8% tax rate. The highest tax rate since World War II occurred during President Clinton's term, when the tax rate hit 33.6%.

As a whole, our government consumes roughly one third of what the private sector creates. There are other countries with higher tax rates. However, the truth remains that no nation has ever taxed itsself to prosperity. America achieves prosperity in spite of government, not because of it. The best thing that the government can do to increase prosperity is get out of the way.

No comments:

Post a Comment